250Rocket

Well-known member

The BRICS countries are considering starting an internal gold trading platform, according to Russian officials. When this happens, the global economy will be significantly reshaped, and the West will lose its dominance, predicts a precious metals expert.

“As Bejing and Moscow understand that America used the dollar to control the world, by implementing a new kind of ‘Gold standard 2.0’ they want to distance themselves from this control. Furthermore, the vast majority of the people in Asia sees gold as superior, or ‘real’ money, something the West has forgotten, because of all the paper wealth (credit) they have accumulated,” said Grass.

https://www.rt.com/business/412546-china-russia-gold-standard-dollar/

While the plebs are jumping on board en mass to digital fools gold out of greed, it seems like the east is looking at setting up true wealth via a new gold standard. They've been amassing the yellow stuff like crazy, by some accounts even more so off the books.

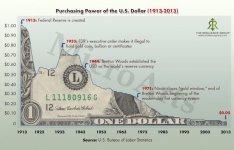

Gold and Silver has always been genuine wealth and we're doomed to repeat history from the day Nixon abolished the gold standard. It's going to be a total blind side to most, especially the average American. Little do they realize how much precious metals are being manipulated downwards by paper shorts on the COMEX.

On a side note, I can't help but laugh at Bitcoin fanatics who praise the entry of Wall street. Firstly the whole concept was for Bitcoin to be independent of the corrupt fiat system but do they really think it'll be to their benefit? Wall street's gonna hoover up the little money by playing their games with their billions then ultimately squash Bitcoin as they do PMs because it's an enemy to their rigged dollar printing press.

By no means is it a certainty that Russia and China will go through with it any time soon, but if they do, be sure you're holding some shiny stuff in a vault somewhere. The more likely scenario is that they let the dollar fail by itself and then kick on their system like a financial back-up generator.

For future reference this weekend Gold is $1248 USD per ounce and Silver is $15.85 USD/oz